The 2-Minute Rule for Palau Chamber Of Commerce

Table of ContentsThe Palau Chamber Of Commerce DiariesGetting The Palau Chamber Of Commerce To WorkThe Facts About Palau Chamber Of Commerce UncoveredThe 15-Second Trick For Palau Chamber Of CommerceThe Basic Principles Of Palau Chamber Of Commerce Palau Chamber Of Commerce Things To Know Before You Buy

Integrated vs. Unincorporated Nonprofits When people assume of nonprofits, they commonly think about incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Structure, and various other officially developed companies. Nonetheless, lots of people participate in unincorporated nonprofit organizations without ever before realizing they've done so. Unincorporated not-for-profit associations are the outcome of two or even more individuals teaming up for the purpose of giving a public advantage or service.

In some situations, donors may start with a much more moderate in advance financial investment as well as after that plan to add even more possessions over time. Since making sure recurring compliance with diverse state and also government requirements can prove challenging, lots of structures engage expert lawyers, business advisors, and/or various other professionals to help team with governing conformity and also various other functional tasks.

Some Of Palau Chamber Of Commerce

The possessions remain in the count on while the grantor lives and the grantor may manage the assets, such as dealing supplies or real estate. Palau Chamber of Commerce. All assets transferred right into or bought by the depend on stay in the trust fund with income dispersed to the designated recipients. These trusts can make it through the grantor if they include a stipulation for continuous administration in the paperwork utilized to develop them.

This technique swimming pools all donations right into one fund, spends those incorporated funds, and pays the resulting revenue to you. When you die, the depend on disperses any kind of remaining possessions to the assigned charity. The easiest means to establish a charitable trust fund is via a significant life insurance, monetary services, or investment management firm.

Alternatively, you can employ a count on attorney to assist you produce a charitable trust fund and recommend you on exactly how to handle it moving on. Political Organizations While the majority of other types of nonprofit companies have a minimal capability to get involved in or supporter for political activity, political organizations run under different regulations.

The Palau Chamber Of Commerce Diaries

As you assess your alternatives, make sure to seek advice from a lawyer to figure out the ideal approach for your organization and also to guarantee its correct setup.

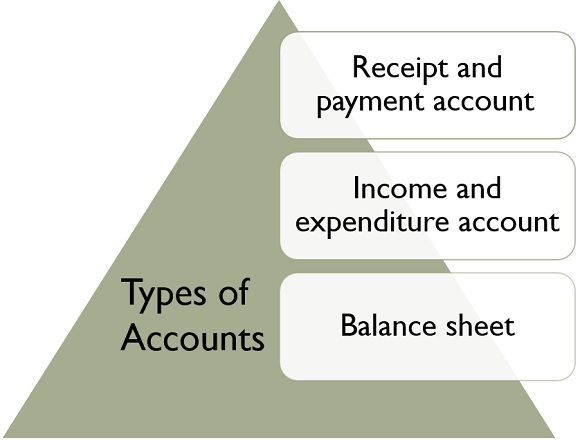

There are lots of kinds of nonprofit organizations. All possessions as well as earnings from the nonprofit are reinvested right into the company or donated.

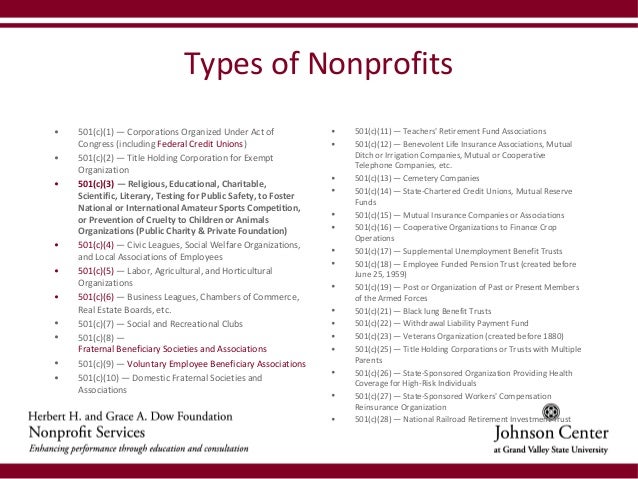

501(c)( 1) 501(c)( 1) are nonprofits organizations that are arranged by an Act of Congress such as government lending institution. Because these organizations are established by Congress, there is no application, as well as they do look at this site not need to submit a tax return. Payments are permitted if they are created public functions.

See This Report about Palau Chamber Of Commerce

In the USA, there are around 63,000 501(c)( 6) companies. Some examples of widely known 501(c)( 6) companies are the American Ranch Bureau, the National Writers Union, and the International Association of Satisfying Organizers. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or recreation clubs. The objective of these nonprofit organizations is to arrange activities that result in enjoyment, recreation, and socializing.

501(c)( 14) - State Chartered Credit Union and Mutual Reserve Fund 501(c)( 14) are state legal credit history unions as well as mutual get funds. These companies provide monetary solutions to their participants and the neighborhood, commonly at discounted rates.

In order to be qualified, a minimum of 75 percent of members need to exist or previous members of the United States Army. Financing originates from donations and also federal government gives. find more info 501(c)( 26) - State Sponsored Organizations Offering Health And Wellness Protection for High-Risk Individuals 501(c)( 26) are nonprofit companies produced at the state degree to provide insurance for high-risk people that might not have the ability to get insurance policy via other means.

Unknown Facts About Palau Chamber Of Commerce

501(c)( 27) - State Sponsored Workers' Payment Reinsurance Company 501(c)( 27) nonprofit companies are produced to offer insurance for employees' compensation programs. Organizations that give employees payments are needed to be a participant of these companies as well as pay fees.

Getting My Palau Chamber Of Commerce To Work

We talk about the actions to becoming a not-for-profit additional right into this web page.

The most important of visite site these is the capability to acquire tax obligation "exempt" condition with the internal revenue service, which permits it to obtain contributions without gift tax, enables contributors to subtract donations on their revenue tax obligation returns and also exempts a few of the organization's tasks from revenue taxes. Tax excluded status is essential to lots of nonprofits as it motivates donations that can be made use of to sustain the objective of the organization.